Fiscal Year Variant

- Rajesh Sharma

- Apr 14, 2023

- 3 min read

What is Fiscal Year Variant?

The fiscal variant contains the number of posting periods in the fiscal year and the number of the special periods. You can define a maximum 16 posting periods for each fiscal year in the Controlling Component (CO).

Type of Fiscal Year

Calendar Fiscal Year

In a calendar fiscal year, there are 12 posting periods that correspond to the 12 calendar months, with the first posting period starting on January 1. When you use the calendar year as the fiscal year, it’s not necessary to define individual posting periods. The start and end date of each posting period is the same as that of the corresponding calendar month. Depending on the posting date, the system assigns the correct period to a transaction. SAP identifies documents using the document type, fiscal year, and posting period. It uses fiscal year variants (FYVs) to manage fiscal years and posting period variants (PPVs) to open or close posting periods. Calendar year checkbox is marked for calendar fiscal year and periods folder does not require entries.

Non Calendar Fiscal Year

A fiscal year not corresponding to a calendar year is known as the non-calendar fiscal year. In this case, the posting periods may or may not correspond to the calendar months. A non-calendar fiscal year, for example, may start July 1 and end June 30th of the following year, or it may start July 16 and end July 15 of the following year. It’s also possible that such a fiscal year has fewer than 12 posting periods (shortened fiscal year). Hence, it’s necessary that you define the number of posting periods required. You also need to define how the system is to determine the posting period (and the fiscal year). There are two possibilities, as shown in Figure below: the posting period is the same as that of a calendar month, or the posting period doesn’t correspond to a calendar month.

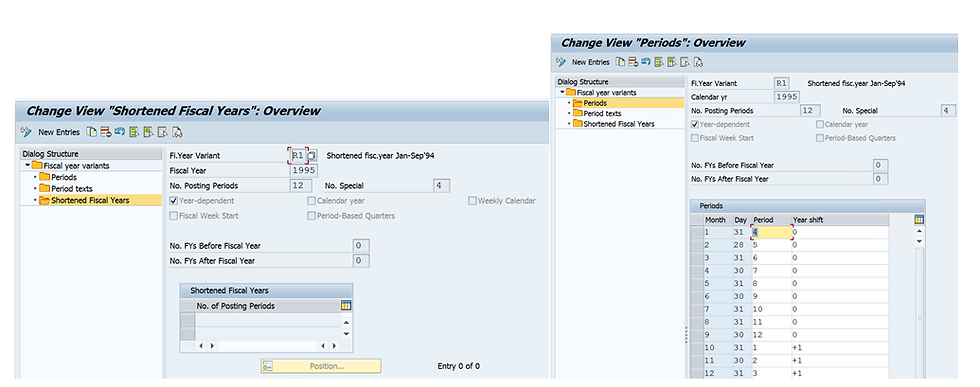

Non-Calendar Year Fiscal Year Type with Posting Period Equal to Calendar Month

You need to specify the calendar month for the posting period and the day limit for each of the periods. You also specify a year displacement factor (or year shift) for each of the posting periods, as described in below, to adjust the fiscal years because they aren’t equal to the calendar year. The year shift can be 0, –1, or +1. Note that you need to specify the end date of February as the 29th, so that even in a leap year, the system can post correctly; if the end date is the 28th, then a posting made on the 29th will be posted to the next posting period. The formula is fiscal year minus calendar year = Year Shift.

Non-Calendar Year Fiscal Year Type with Posting Period Not Equal to Calendar Month

When the start and end dates of posting periods don’t match the start and end of calendar months, you need to maintain the difference by specifying the date of the period-end.

Shortened Fiscal Year

A fiscal year that is shorter than 12 months is known as a shortened fiscal year. You require such a fiscal year during the initial periods of establishing a company, when you want to switch from a calendar fiscal year to a non-calendar year or vice versa, or when you make your company part of a new enterprise. Note that a shortened fiscal year isn’t calendar or year dependent (applicable only to that particular year) and should always be followed by a complete fiscal year. Both the shortened fiscal year and the following or previous complete fiscal year are defined using the same FYV.

Special Period

No matter what type of fiscal year you use, SAP allows you to divide the last posting period into special periods to facilitate closing operations. The special periods help you create more than one supplementary financial statement. If you don’t need 12 posting periods in a fiscal year, you can employ the unused regular posting periods as special periods. In SAP G/L accounting, you can have a maximum of 16 periods, including 4 special periods. However, in Special Purpose Ledgers (FI-SL), you can use a maximum of 366 posting periods. Note that special periods subdivide the last posting period into one or more closing periods but don’t create new posting periods. See an example below that explains a scenario where 3 special posting periods have been configured. In this case, document posting date is always Dec XX with posting period selected as period 13, period 14 or period 15.

Maintain Fiscal Year Variant

Assign Company Code to Fiscal Year Variant

Rajesh Sharma

SAP WM/EWM Functional Consultant

§ Linked in profile: https://www.linkedin.com/in/rajesh-sharma-3a565821/

§ Twitter: RajeshS98151512/ RAJESH SHARMA@RAJESHS21287609

§ SAP Blogs: https://www.sastrageek.com/blog

EPS Machine EPS Cutting…

EPS Machine Eps Raw…

EPS Machine EPS Recycling…

EPS Machine EPS Mould;

EPS Machine EPS Block…

EPP Machine EPP Shape…

EPTU Machine ETPU Moulding…

EPS Machine Aging Silo…

EPTU Machine ETPU Moulding…

EPS Machine EPS and…

EPS Machine EPS and…

AEON MINING AEON MINING

AEON MINING AEON MINING

KSD Miner KSD Miner

KSD Miner KSD Miner

BCH Miner BCH Miner

BCH Miner BCH Miner