Tax Procedure - Basic Settings in SAP FICO: A Step-by-Step Guide

- Javesh pal

- Aug 20, 2024

- 3 min read

Setting up tax procedures is a fundamental part of configuring SAP FICO to ensure compliance with local tax regulations and accurate financial reporting. This guide will walk you through the basic settings for tax procedures using the OBBG code in SAP FICO.

Introduction to Tax Procedures

SAP FICO provides pre-configured tax procedures tailored to various countries, simplifying tax setup complexity. These settings replace custom procedures, enabling efficient implementation aligned with local regulations. By leveraging these options, businesses streamline processes and ensure compliance with diverse tax laws globally. This enhances operational efficiency within SAP FICO’s financial modules, allowing organizations to confidently navigate complex tax landscapes and prioritize strategic initiatives over configuration tasks.

Navigating to Tax Procedure Settings

Path:

- SPRO

- Financial Accounting

- Financial Accounting Global Settings

- Tax on Sales/Purchases

- Basic Settings

- Assign Country Region to Calculation Procedure.

This path leads you to the configuration screen where you can assign tax procedures to specific countries.

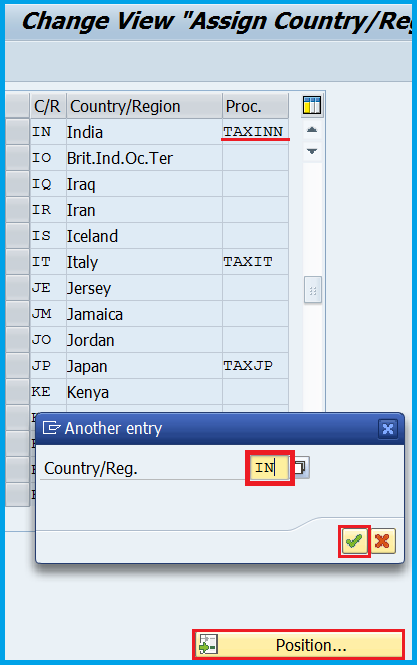

Assigning Country-Specific Tax Procedures

SAP provides a wide range of tax procedures tailored for different countries. Here’s how to assign a tax procedure to a country:

Selecting a Country:

Click on the dropdown list to view available countries and their corresponding tax procedures.

For example, if you're setting up tax procedures for India, you'll see options like "Sales Tax Procedure for India."

Choosing a Pre-Configured Procedure:

Instead of creating a new tax procedure, you can select from the pre-configured options provided by SAP.

This not only saves time but also ensures that you’re using a tax procedure that is compliant with local regulations.

Example: Setting Up Tax Procedure for India

Let's go through a practical example of setting up a tax procedure for India:

1. Positioning the Country:

Use the Position button to locate the country India (IN) in the list. 2. Selecting the Tax Procedure:

For India, you might see a default procedure such as TAXINN (New Indian Taxes).

Select TAXINN or another relevant procedure from the list. 3. Saving the Configuration:

After selecting the appropriate tax procedure, click Save to apply the settings.

This step completes the assignment of the tax procedure to the country.

Practical Considerations

Consistency: Ensure that the selected tax procedure aligns with your organization’s financial policies and local regulatory requirements.

Flexibility: While using pre-configured procedures is recommended, make sure they can accommodate any specific needs your organization might have.

Compliance: Regularly review and update the tax procedures to stay compliant with changes in tax laws and regulations.

Conclusion

Setting up tax procedures in SAP FICO is a critical step for ensuring accurate tax calculation and compliance with local laws. By leveraging SAP’s pre-configured tax procedures, you can streamline the configuration process, reduce errors, and maintain consistent financial reporting. Following the steps outlined in this guide, SAP FICO users can efficiently manage tax settings, leading to better financial control and decision-making within their organizations.

By understanding and properly configuring tax procedures, SAP FICO consultants and professionals can ensure that their financial systems are robust, compliant, and capable of handling the complexities of global tax regulations.

Why Choose Sastrageek?

Expert-Led Training: Learn from industry professionals with extensive experience in SAP FICO.

Hands-On Learning: Engage in practical, real-world exercises to cement your understanding.

Career Support: Gain access to our internship program to further support your professional development and enhance your resume.

At Sastrageek Solutions, we specialize in providing comprehensive SAP FICO Training designed to equip professionals with the skills needed to excel in Financial Accounting and Controlling. Our expert trainers, with over 20 years of experience in the SAP domain, deliver in-depth knowledge and hands-on experience through our meticulously crafted SAP FICO Training courses.

Whether you're a beginner or looking to enhance your SAP FICO skills, our training programs cater to all levels, ensuring you stay ahead in your career. Our SAP FICO Training covers key aspects such as General Ledger Accounting, Accounts Payable and Receivable, Asset Accounting, Cost Center Accounting, and Profitability Analysis, ensuring a well-rounded understanding of the SAP FICO module. Join our SAP FICO Training today and unlock the potential of SAP Financial Accounting and Controlling to drive efficiency and accuracy in your organization's financial processes.

Take the first step towards a successful career in SAP FICO.

Check out the details: Sastrageek SAP FICO Training

JAVESH PAL SAP S/4 HANA FICO Consultant

§ Linked in profile: https://www.linkedin.com/in/ficowithjavesh/

§ SAP Blogs: https://www.sastrageek.com/blog

Nightmares shouldn't cost you—download free horror games!

Unduh software premium gratis tanpa batas di Bagas31!

Akses game dan software premium tanpa biaya di Enscape Kuyhaaa!

Setting up tax procedures in SAP FICO is like fine-tuning your ride in CarX Street Drive for PC precision is key! Configure tax codes, assign accounts, and optimize settings for smooth financial "handling." Just like in racing, the right setup ensures efficiency, speed, and total control over the road ahead!

"Mastering tax procedures in SAP FICO is like navigating Beach Buggy Racing on PC both require precision, strategy, and attention to detail. Just as you customize your buggy for the track, configure tax settings step-by-step to ensure smooth financial operations. Stay sharp, avoid pitfalls, and race toward compliance with confidence!"